Spring isn’t just about budding plants, changing the clocks, or paying your tax bill. It can be the perfect time to refresh financial tasks and dust off your long-term goals. As we begin a new season of financial “spring cleaning,” here are 4 (commonly made) mistakes you can prevent this year.

How much do you need to retire wealthy? Believe it or not, there’s no set number for anyone. Lifestyle and the quality of your retirement plan are certainly two big factors. But when considering the economy and inflation, a definitive picture of our financial future can feel somewhat elusive. So, to shed a little light (and provide a little guidance), here are a few telltale signs you might be set up for a “comfortable” post-work lifestyle.

What’s your ideal retirement? Traveling? Practicing your favorite hobbies? Caring for loved ones? Whatever you envision, creating a plan of action can feel exhausting. There are, however, a few simple, yet commonly overlooked steps you can take today to help you feel more comfortable throughout your planning process.

Smart investing doesn’t happen in a vacuum. Current events matter, and this year, the 2024 Presidential Elections are taking center stage. That’s rattling a lot of us, causing more election stress than ever before.1 It’s also raising a lot of questions about investing in election years, how to respond to market uncertainty, and what money moves truly make sense. Here’s a handful of key factors to keep in mind when you’re investing in an election year.

The rollercoaster of investor psychology can take over and push markets in directions that don’t always jibe with the underlying financial and economic fundamentals. A lot is going on, so let's discuss.

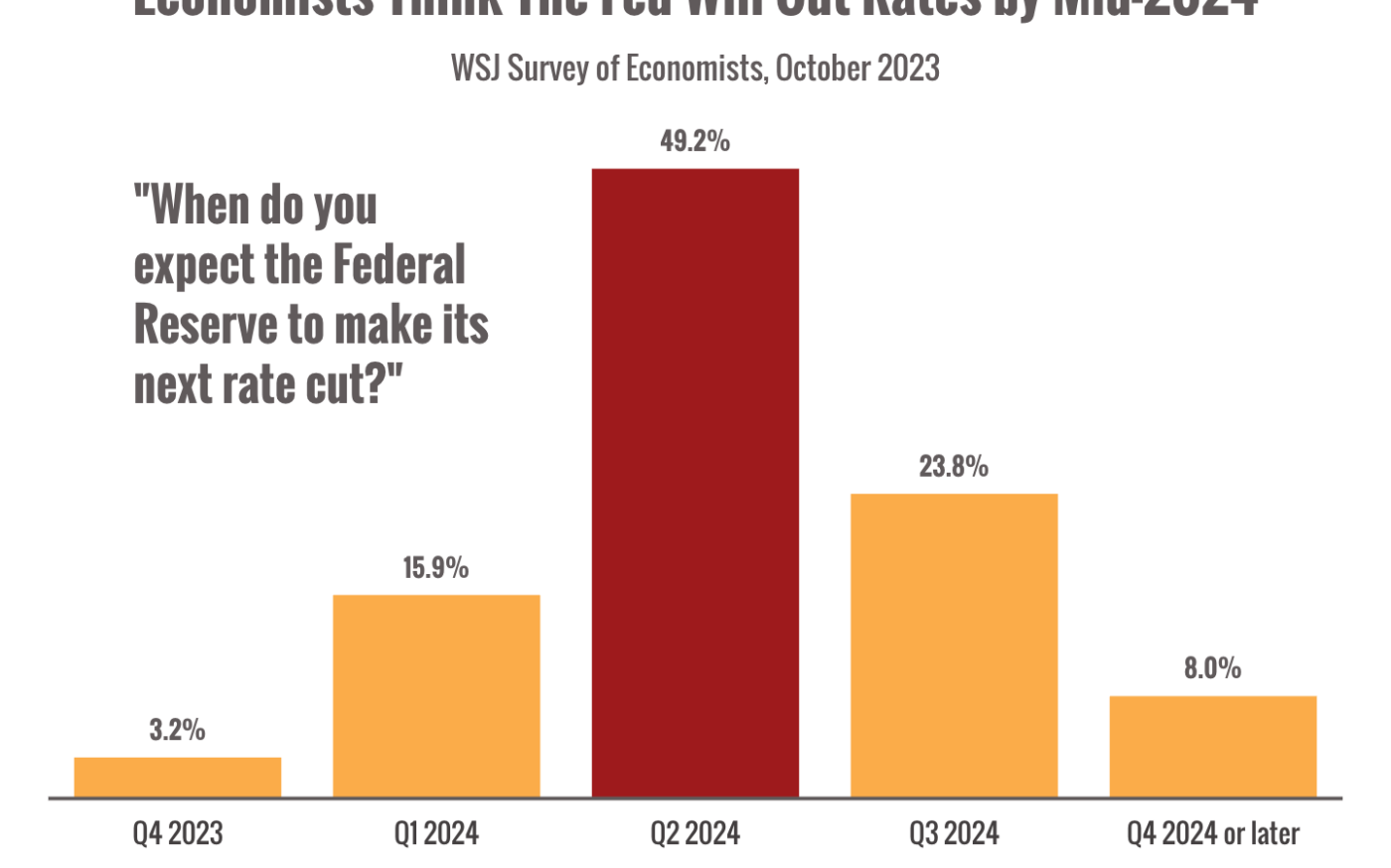

As we kick off 2024, the latest data is raising some concerns about inflation. Let’s dive into some data and take a look.

As we enter the final weeks of 2023, let’s take a moment to review some of the year's major market and economic trends.

Happy Thanksgiving! I’m grateful for you.

Do you feel like the economy isn’t making a lot of sense right now? There’s a big divide between the current data and what many Americans are feeling.

Markets have been hitting some positive milestones lately, but it’s not clear whether or not the bear market is actually over just yet. Let’s discuss.

Markets are doing their thing again. Markets tumbled, and then bounced back, so let’s discuss.

From retirement savings to living abroad, here are some of our commonly asked questions.